Not known Facts About Tax Consultant Vancouver

Table of ContentsThe Single Strategy To Use For Cfo Company VancouverThe 8-Minute Rule for Small Business Accountant VancouverThe 7-Minute Rule for Tax Consultant VancouverThe smart Trick of Vancouver Tax Accounting Company That Nobody is Talking AboutThe Of Tax Accountant In Vancouver, BcSome Known Factual Statements About Tax Accountant In Vancouver, Bc

Right here are some benefits to working with an accountant over a bookkeeper: An accountant can offer you a thorough view of your service's economic state, together with methods and also suggestions for making financial decisions. Meanwhile, accountants are just in charge of recording monetary purchases. Accountants are needed to finish even more schooling, certifications and work experience than bookkeepers.

It can be difficult to determine the suitable time to employ an accounting professional or bookkeeper or to figure out if you need one whatsoever. While lots of small companies hire an accountant as a consultant, you have a number of options for handling monetary jobs. Some little business owners do their very own bookkeeping on software program their accounting professional recommends or utilizes, providing it to the accountant on a weekly, regular monthly or quarterly basis for activity.

It might take some background research study to discover an ideal bookkeeper since, unlike accounting professionals, they are not needed to hold a specialist certification. A solid recommendation from a relied on coworker or years of experience are vital elements when working with a bookkeeper. Are you still unsure if you need to work with someone to help with your publications? Here are 3 circumstances that indicate it's time to employ a financial professional: If your tax obligations have actually come to be too complicated to handle on your own, with several earnings streams, international financial investments, several reductions or other factors to consider, it's time to work with an accountant.

Vancouver Tax Accounting Company Things To Know Before You Get This

For small companies, experienced money monitoring is an essential element of survival and growth, so it's smart to deal with a monetary specialist from the beginning. If you favor to go it alone, think about beginning out with audit software and also keeping your books thoroughly up to day. This way, need to you need to employ a specialist down the line, they will have visibility into the total financial background of your business.

Some source interviews were conducted for a previous variation of this short article.

The Facts About Pivot Advantage Accounting And Advisory Inc. In Vancouver Uncovered

When it concerns the ins as well as outs of tax obligations, audit and money, however, it never ever injures to have a knowledgeable specialist to turn to for assistance. A growing variety of accounting professionals are also dealing with things such as capital estimates, invoicing and also human resources. Ultimately, much of them are tackling CFO-like roles.

Little service owners can expect their accountants to assist with: Selecting the company framework that's right for you is essential. It impacts just how much you pay in taxes, the documents you require to file as well as your personal obligation. If you're wanting to transform to a different business framework, it could cause tax obligation effects and various other problems.

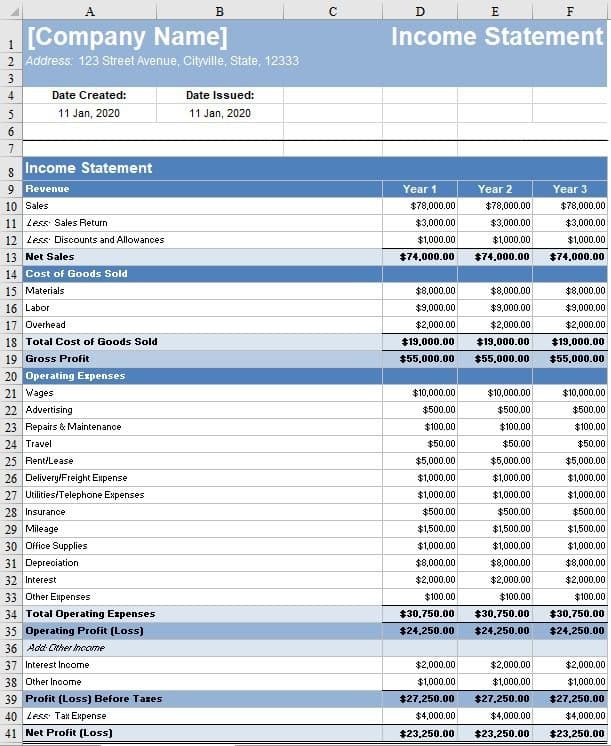

Also try this website business that coincide size and also market pay very various amounts for bookkeeping. Prior to we get involved in dollar numbers, allow's talk about the costs that enter into local business bookkeeping. Overhead expenditures are prices that do not directly become an earnings. These prices do not transform right into cash money, they are required for running your company.

The Best Strategy To Use For Vancouver Accounting Firm

The typical price of audit solutions for small company varies for every distinct scenario. However given that accountants do less-involved jobs, their prices are typically more affordable than accounting professionals. Your economic service charge depends on the job you need to be done. The ordinary monthly accounting fees for a local business will certainly climb as you add more services and also the tasks obtain tougher.

You can record deals as well as process payroll using on the internet software application. Software application options come in all shapes and dimensions.

:max_bytes(150000):strip_icc()/Accountingpolicies_color-6c5485e2b09541c697abd98d3094534c.png)

The 4-Minute Rule for Cfo Company Vancouver

If you're a new organization owner, do not forget to factor bookkeeping costs into your budget plan. Management prices and accountant charges aren't the only audit costs.

Your find here ability to lead workers, offer consumers, and choose could experience. Your time is likewise click to investigate important and also need to be taken into consideration when looking at bookkeeping prices. The moment spent on audit jobs does not generate earnings. The less time you invest in bookkeeping as well as tax obligations, the more time you need to expand your service.

This is not intended as legal recommendations; for even more details, please go here..

The 6-Minute Rule for Virtual Cfo In Vancouver